The analysis of the real estate market is derived from the French property marker report of notaires de France. It presents the real estate situation in France: trend and evolution of real estate prices.

Inquire

Consult the french property market report No57 in this interactive version

Decline

At the end of August 2022, the cumulative volume of older property transactions over the last twelve months in France (excluding Mayotte) reached 1,145,000 transactions.

Image (1000*yyy)

After 15 months ofincrease over one year, reaching a peak of morethan 1.2 million sales in September 2021, volumes reported a slow decrease (-3.7% in June and -5.6.5% in August over one year), even thoughthey remain exceptionally high, following two unusual years, indicating a volume of around 1.1 million sales for the year-end. In particular, notaries reported a slowdown in September and October with longer selling periods. At the same time, the slowdown in price rises has begun even though a decrease is not imminent. The decrease in volumes occurs before the fall in prices, but the notaries already note negotiations on prices which did not exist a few months ago.

The decline confirms that 2023 will be objectively less remarkable in terms of volumes, but the decline should take place smoothly, as announced by the notaries.

Against the current, specifically in the Capital, there is a strong recovery in volumes and a shortage of available properties, likely to put high pressure on prices.

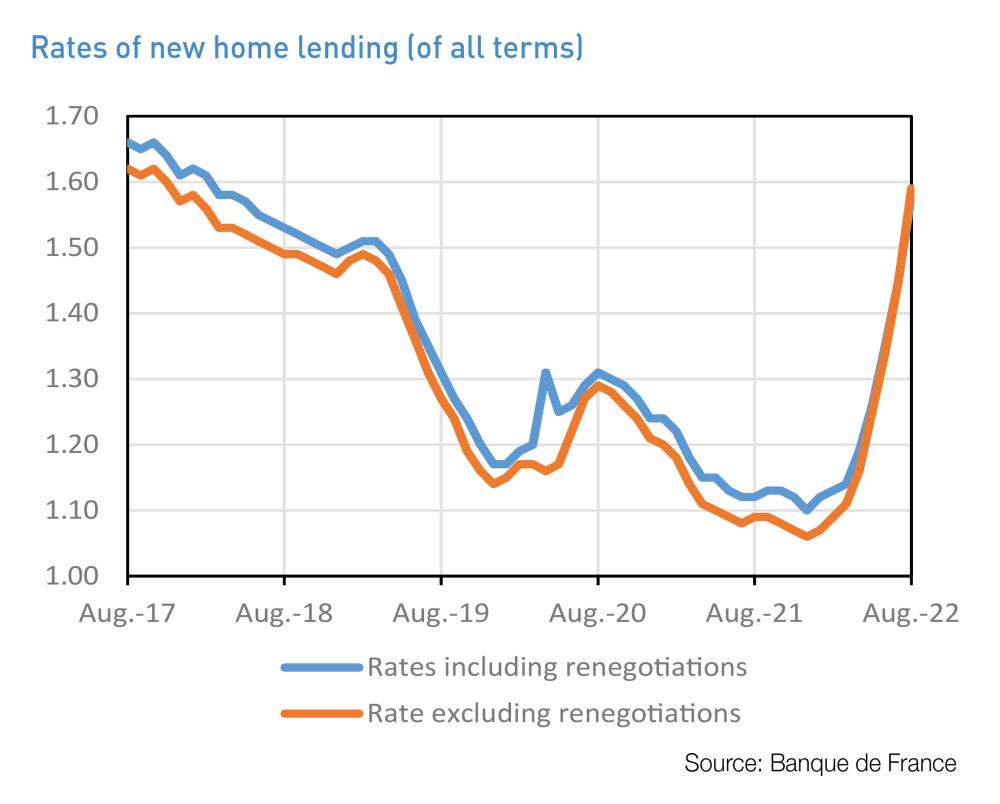

Nevertheless, the economic and geopolitical environment remains dominated by uncertainties in a period of instability. The real estate market cannot remain unaffected. As such, the sharp increase in rates on housing loans to 1.72% in September after 1.1% in January leads to a decline in average debt capacity that is expected to continue and amplify. Long-term rates now stand at more than 3%. While the usury rate has been a problem in recent months, its rise at 1 October once again rovides a breath of fresh air. However, it should be noted that some buyers wish to sign contracts quickly for fear of an expected rise in rates. For several months, commercial banks' room for manoeuvre diminished by the reduction of the gap between the prevailing usury rate and the 10-year OAT rate. The credit offer is therefore automatically limited and instead of being a necessary consumer protection tool, it leads to a shortage of credit, or even credit exclusion, even for good profiles that do not reach the maximum debt rate of 35%. An insufficient rise or one that is too spaced over time in usury rates, at a pace different from the rise in bank rates, creates a bottleneck that paradoxically complicates access to real estate credit and therefore excludes, in fact, some households.

Questioned during the first half of October1, Notaires de France noted that in 18.1% of the meetings concerning real estate projects, the usury rate is an important issue likely to postpone the signature. They also note that in 19% of cases, the issue of usury rate may affect the completion

of a sale. This has an even greater impact for the major offices of metropolitan areas. A proportion of 93.4% of notaries considers that the usury rate is a more significant issue in their exchanges with their clients since the rise in rates, and 95.8% of them consider that its impact on the viability of real estate projects is more severe.

Notwithstanding this rise in rates, it should be recalled that real interest rates have never been so low since the 1970s, still being attractive for some buyers, particularly with regard to inflation (at 6.2% in October, level not seen since 1985), so that the loan constitutes an investment. Moreover, the guarantee of a fixed rate avoids being dependent on market fluctuations, by the decorrelation of the loan to the value of the asset, a necessary safeguard.

The real estate market cannot and will not remain unaffected by ups and downs and fluctuations in macroeconomic parameters. But there is no need for alarm at this time, even if inflation and energy costs will greatly impact the purchasing power of

French people in the coming months. As such, French people are increasingly concerned about the energy performance of properties and the level of the proposed energy performance certificate; they are increasingly influencing negotiations, particularly on the housing market or in rental sector.

However, the fundamentals of the existing property market are there, which continues to receive offers from users, far from any real estate bubble. In uncertain times, bricks and mortar remain more than ever a safe investment in an undecided and unpredictable environment.

1 - On-line survey carried out by the CSN on 12/08 October 2022 among all notaries in France; 2,295 completed questionnaires returned representing 14.8% of notaries in 30.8% of notarial offices.

In the second quarter of 2022, prices of older properties continued to slowly decrease

In mainland France, in the second quarter of 2022, the rise in the prices of old properties continued despite a slight change, +1.3% compared to the first quarter of 2022 (provisional data corrected for seasonal variations). Year on year, prices continued to rise by +6.8%, then +7.3 %. The increase remains more significant for houses (+8.5% year-on-year in Q2 2022) than for apartments (+4.5.0%) since Q4 2020.

Outside of Paris, in Q2 2022, old property prices increased by +1.7% over a quarter. Year-on-year, prices remain very dynamic. +8.6% in Q2 2022, after +9.2%. Since the beginning of 2021, the prices of houses outside Paris (+9.5% year-onyear in Q2 2022) have risen stronger than those of apartments (+7.6%), which did not happen in 2019 and 2020.

In the Île-de-France region, in Q2 2022, old property prices rose for the second consecutive quarter, with +0.3% in a quarter, after +1.1% and -0.2% in the previous two quarters. Over one year, prices also increased, with +2.2% in Q2 2022. This increase is significantly higher for house prices (+5.4% over one year, after +5.9% in the second quarter and +6.6% in the first quarter) than for apartments (+0.7% over one year, after +0.9% and +0.3%). This stronger growth of house prices in the Île-de France region has been observed since the fourth quarter of 2020. In Paris, apartment

prices changed slightly over a quarter, with +0.1% in Q2 2022, after stability in Q1 2022 and -1.% in Q4 2021. Over one year, prices of Paris apartments dropped by -0.8 %.

Preliminary contracts

In mainland France, according to projections resulting from the preliminary contracts at the end of December-2022, the slowdown in the price of old properties continues. +5.7% year-onyear at the end of December 2022 (compared to +6.8% in Q2 2022).

This slowdown seems to be very significant for the prices of old houses (+6.4% versus +8.5% in Q2) while prices of old apartments increased at the same pace (+4.8%, compared with +4.5% in Q2.

According to the prices indicated in preliminary contracts, the price per m² of apartments in the Capital is expected to be €10,620 in December-2022, at the same level as a year before. As has been the case for many months, price changes therefore remain very moderate, far from the strong variations sometimes announced. Prices ranged between €10,500 and €10,800 per m², with slight increases and then decreases from December 2020 to December 2022.

The new housing market - Key figures

Image (1000*yyy)

The increase in building costs, linked to inflation and prices of raw materials, new environmental standards and the scarcity of land driven by the Zero Net Artificialisation (ZAN) set for 2050, not to mention the gradual loss of attractiveness of the Pinel system, has brought the new housing market to an economic impasse. The development of the old housing market logically follows that of the new housing market, with a certain lag. It is in fact mainly fuelled by the resale by first-time buyers of properties.

Credit - Banque de France data - Results at the end of August 2022

The annual growth rate of outstanding housing loans was stable in August-2022 at +6.3 %, at a high level. The monthly season adjusted index flow - resulting from the difference between new and repaid loans - amounts to €5.6bn, which is slightly higher than its average over the last five years (5.3bn).

Season adjusted index production of home loans reached €21.2bn in August (21.8bn in July), a level that remains high after the peak of €28.8bn in May. This production is close to the 5-year average (20.3bn), reflecting the standardisation process in progress. The very gradual rise in interest rates on new loans is continuing (with a narrowly defined effective rate -NDER-, i.e. excluding fees and insurance, of 1.58% on average in August, after 1.45% in July).

The estimate given for September indicates a continued rise in the average interest rate for new loans, which would reach 1.72%, a monthly seasonally adjusted index production of housing loans, which would continue to normalise gradually (22.6 billion euros), and an almost steady level of +6.2% of the annual growth rate of outstanding loans.

Image (1000*yyy)

Property market: the new housing market

The characteristics of housing sold with energy labels F and G in mainland France (excludind Corsica)

Recent changes to the rules for calculating the energy performance certificate (method 3CL, considering greenhouse gas emissions in the calculation of the energy label), resulting in a redistribution of housing according to the energy performance scale, make it difficult to interpret the developments in 2021 on the distribution and characteristics of

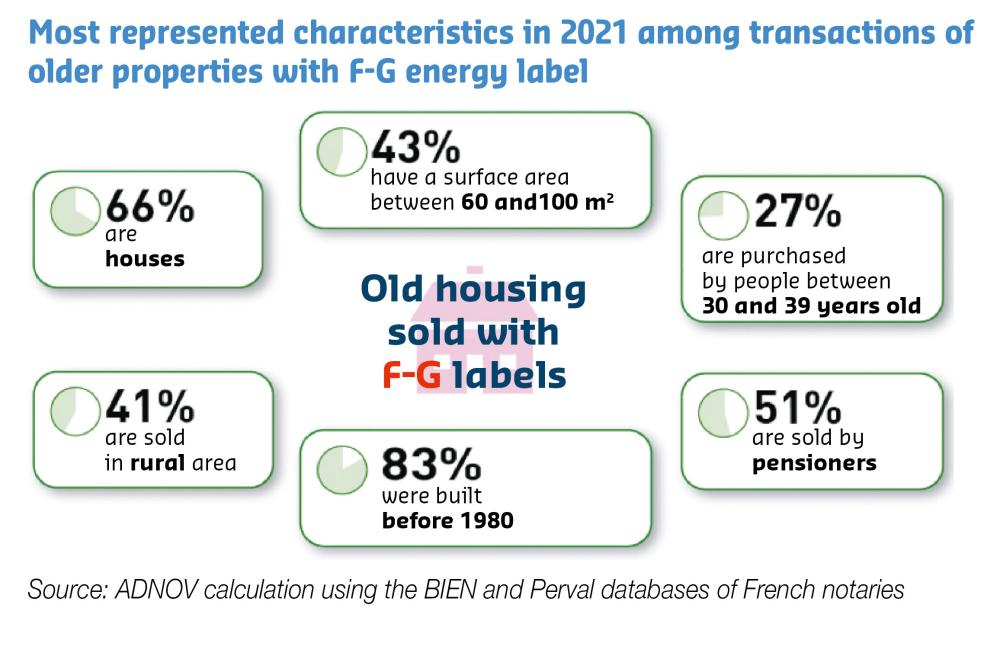

the homes sold under the energy label1. The rest of this analysis will therefore only focus on the findings recorded in 2021, without comparison with a previous period .

In mainland France (excluding Corsica), the distribution of existing housing transactions according to the energy label is almost stable over one year. The least energy-intensive housing units (class A and B) still account for 7% of transactions carried out in 2021. The same applies to the most energyintensive housing units (class F and G) that represent 11% of transactions, even though the analysis of this breakdown by quarter shows a slight increase in the share of class G housing transactions over the 4th quarter of 2021 (5%) compared to the 4th quarter of 2019 (3/%). In addition, it should be noted that the share of class G housing built before 1947 and sold in Q4 2021 increased: by 33/% compared to 18% in Q4 2019 . Although this trend concerns all transactions, the proportion remains smaller (17% in Q4 2021 vs. 14% in Q4 2019). As such, the ban on leasing announced in 2021 of part of class G housing as early as 2023 (those whose primary energy consumption is greater than 450-kWh/m²/year, qualified as inappropriate by the law), accelerated the decision to sell by holders of this type of housing.

Image (1000*yyy)

41% of transactions are carried out in "rural" areas2. They are particularly over represented since this proportion is 30% for all labels combined. A-B label housing also stands out, to a lesser extent, with a larger share of transactions carried out in "the suburbs" (40% vs. 36% on all transactions), to the detriment of the "city centres'. It can be noted that the share of the transactions in the most recent housing (built after 2000) is 19% in the "city centres”, 25% in "the suburbs" and goes up to 28% in the "rural” areas.

66/% of transactions concern houses (compared to 59% on all transactions). 83/% of housing units were built before 1980 (versus 56% on all transactions), well before the introduction of the first thermal regulations with imposed targets (beginning of 2000). In particular, 37% were built during the post-war period from 1948 to 1969 (versus 22.5% on all transactions). The high and urgent demand for housing during this period has not had any impact on the choice and quality of the materials used.

43/% of transactions have a surface area of between 60 and 100 m². This share is equivalent to that recorded on all transactions. Nevertheless, the smallest surfaces (less than 30 m²) are over-represented among F-G label housing transactions. 12% compared to 5% for all labels combined. The consumption of hot water and heating, calculated per m², is higher, making small housing units the most energy-intensive in terms of energy consumption.

51% of F and G housing units are sold by "pensioners" (versus 37.0% on all transactions). This result is partly explained by the type of properties sold by "pensioners". In particular, these are older properties (63% of the properties sold by "pensioners" were built before 1980 compared to 56 % all socio-professional categories combined). These sellers also hold onto their properties much longer (55% of them resell them more than 15 years after the purchase, compared to only 29% of all socio-professional categories combined). These characteristics may have an impact on the "general condition" of the property as well as on the energy label assigned at the time of sale. 79% of sales made by "pensioners" concern properties requiring "works" or "renovation" compared to 67% of all socio-professional categories combined.

1 - The information available in the real estate database of Notaires de France does not allow the identification of transactions according to the "new definition” of energy performance certificates While the new calculation has been applicable since 1 July 2021, it can be assumed that there is still a significant proportion of "old definition" energy performance certificates regarding the sales in the second half-year 2021.

2 - The breakdown used is based on the notion of urban units of INSEE (www.insee.fr/fr/metadonnees/definition/c1441).